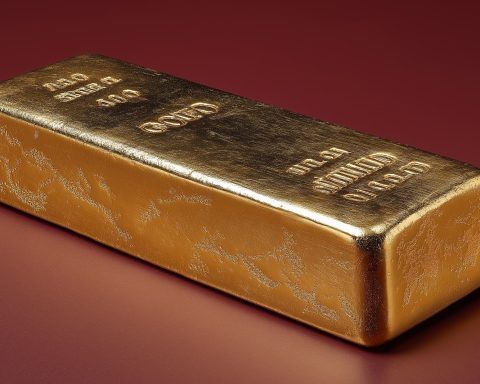

Stocks Soar to Record Highs, Gold Tops $4,000 – What’s Driving 2025’s Historic Rally?

The S&P 500 and Nasdaq hit record closes on Oct. 8, with the S&P up 0.6% to 6,753.72 and the Nasdaq gaining 1.1% to 23,043.38. Gold surged past $4,000 an ounce for the first time, peaking at $4,078. The Federal Reserve signaled more interest rate cuts after its first reduction in September. Tech stocks soared, led by AMD’s 24% jump on an AI chip deal with OpenAI.