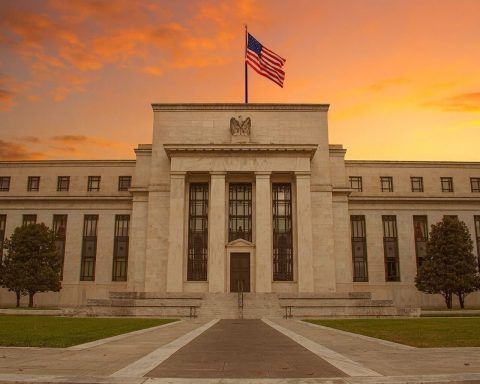

Federal Reserve News Today: Rate Cut Odds Near 90% as Trump Eyes New Fed Chair

On December 4, 2025, Federal Reserve watchers are juggling three big storylines at once: Here’s a detailed, Google‑News–friendly rundown of all the major Federal Reserve news today, what it means, and what to watch next. December 2025 Fed Meeting: Markets See a Near‑Certain Rate Cut The Federal Open Market Committee (FOMC) holds its final meeting of 2025 on December 9–10, with a policy decision and press conference scheduled for December 10. Federal Reserve+1 After weeks of mixed economic data and a historic government shutdown that delayed key statistics, traders now see a December rate cut as overwhelmingly likely: The current