Core Scientific Stock (NASDAQ: CORZ) Drops on Dec. 16, 2025: CoreWeave Data Center Delay, Analyst Forecasts, and What Investors Are Watching Next

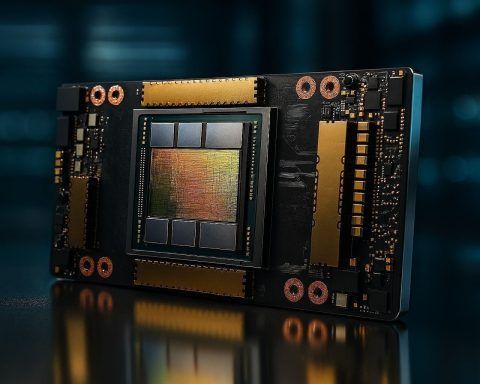

Core Scientific, Inc. (NASDAQ: CORZ) stock slid sharply on Tuesday, December 16, 2025, as investors digested fresh reporting tied to the company’s fast-growing AI data center business—plus a broader wobble in “AI infrastructure” sentiment that’s been hitting anything connected to big-ticket compute buildouts. Shares of Core Scientific fell about 6.2% intraday to roughly $14.34, according to MarketBeat, with trading volume notably below the stock’s average daily pace—one of those days where the market isn’t just repricing, it’s rethinking. MarketBeat Below is what’s driving the move, what the latest forecasts and analyst price targets suggest, and the key milestones that could