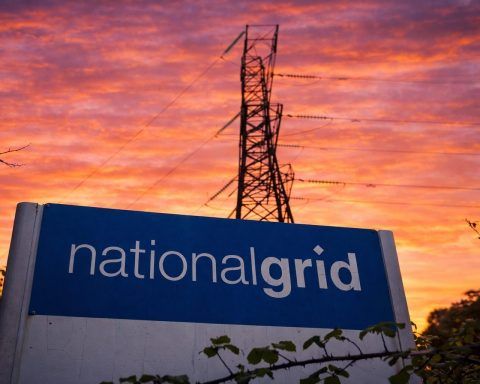

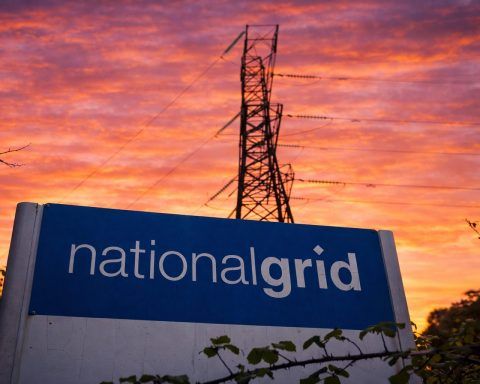

National Grid share price holds near 52-week high after Barclays target hike as Storm Goretti hits power networks

National Grid shares closed up 0.8% at 1,192.5p on Friday, near their 52-week high, after Barclays raised its target price to 1,400p. Storm Goretti caused power outages across Britain, with most supply now restored. Ofgem’s regulatory decisions and storm recovery costs remain in focus. Senior managers made small share purchases under the company’s employee plan.