MSP Recovery (MSPR) Stock Jumps Over 20% Pre‑Market as Q3 Delay and Nasdaq Fight Keep Volatility High – 17 November 2025

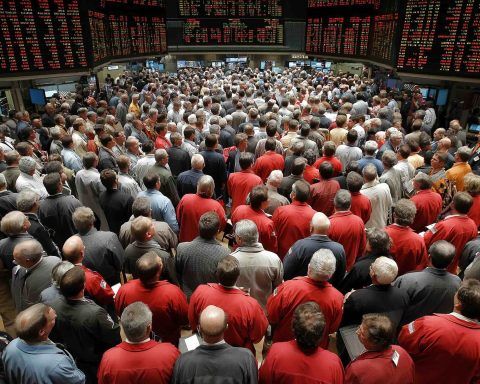

MSP Recovery (MSPR) surged as much as 40% in pre-market trading on November 17, 2025, reaching $0.62 after closing at $0.45 on Friday. The spike came amid heavy volume and no new company news, as traders responded to recent volatility, a late Q3 filing, and ongoing Nasdaq delisting risk. Market cap remains below $1 million, with the company facing a $1.56 billion net loss in 2024 and a $1.2 billion debt restructuring.