Navitas Semiconductor (NVTS) Stock Skyrockets 27% on Nvidia AI Breakthrough – Is a Major Rally Just Beginning?

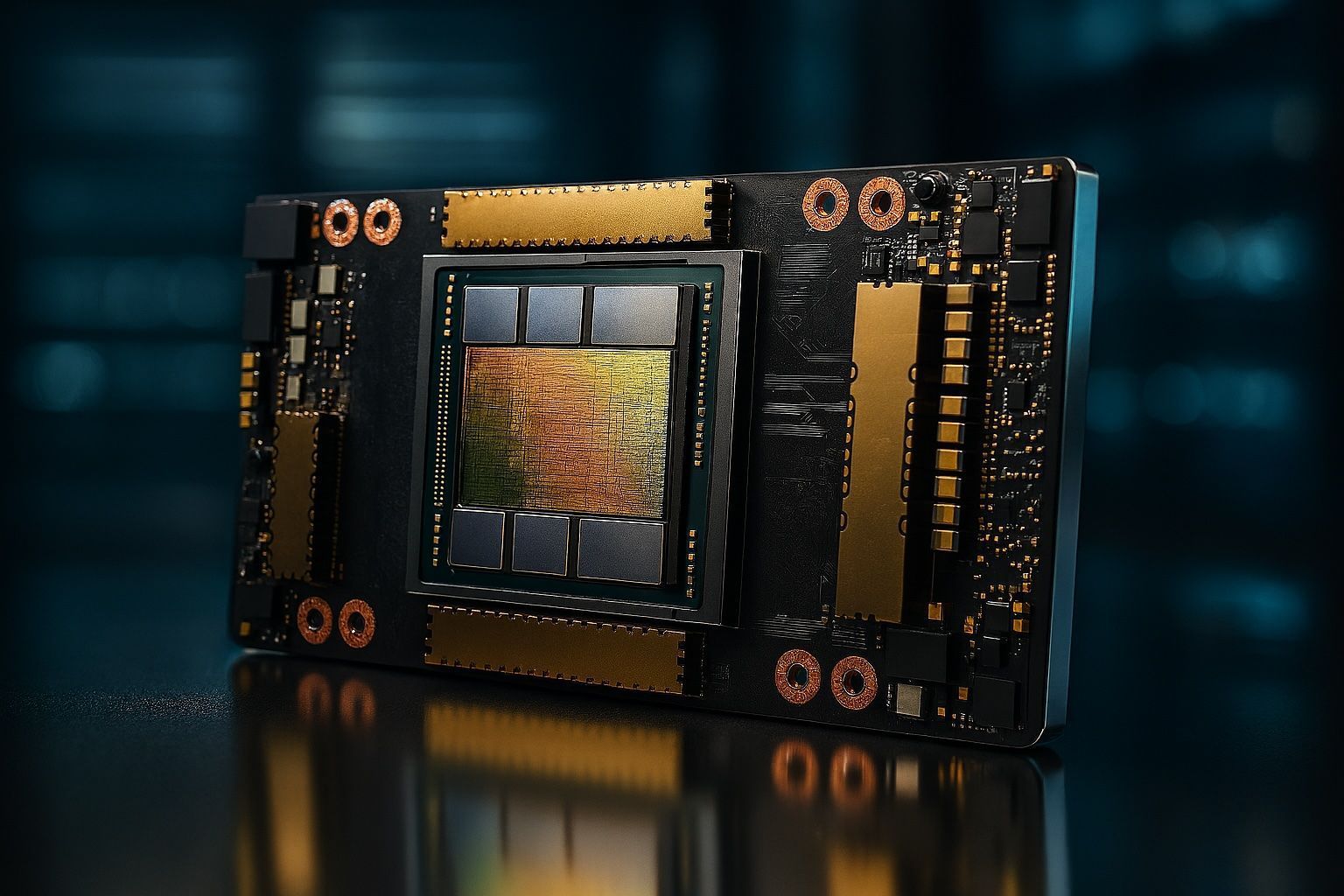

Navitas Semiconductor shares jumped 21% on Oct. 13, 2025, after announcing new GaN/SiC power chips for NVIDIA’s 800V AI data-center architecture. The stock rose to nearly $12.71 in after-hours trading, up 27% on the day. Navitas reported Q2 revenue of $14.5 million, down 29% year-over-year, and expects Q3 sales of about $10 million. CEO Chris Allexandre took over in September, shifting focus to AI data centers and EVs.