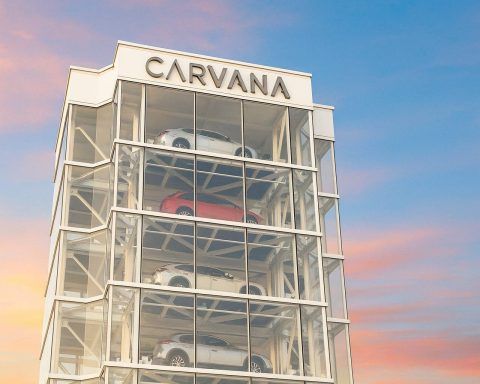

Carvana Stock Soars on S&P 500 Inclusion: What CVNA’s Record High Really Means for Investors

Carvana shares jumped nearly 14% to close at $454.76 on December 8 after S&P Dow Jones Indices said the company will join the S&P 500 on December 22. The stock has soared over 8,000% since late 2022, lifting Carvana’s market value above $80 billion and surpassing Ford and GM. Trading volume approached 9.6 million shares. Carvana reported $5.65 billion in Q3 revenue but still carries about $5.1 billion in debt.