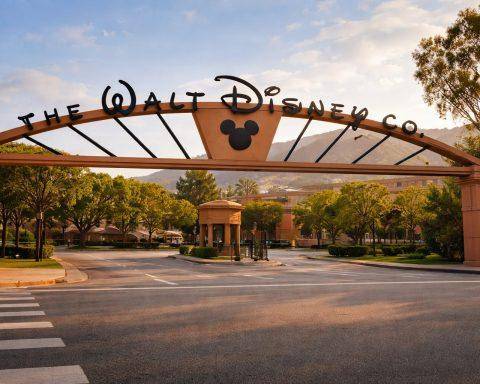

Disney stock ends week higher after Friday bounce — what to watch for DIS next week

Disney shares closed up 3.6% at $108.70 Friday, recovering from earlier losses as U.S. stocks rallied and the Dow topped 50,000. Investors are watching Super Bowl streaming economics and Disney’s CEO transition, with Josh D’Amaro set to take over at the March 18 meeting. Disney reported quarterly revenue of $25.98 billion and adjusted EPS of $1.63, while segment operating income fell 9% to $4.6 billion.