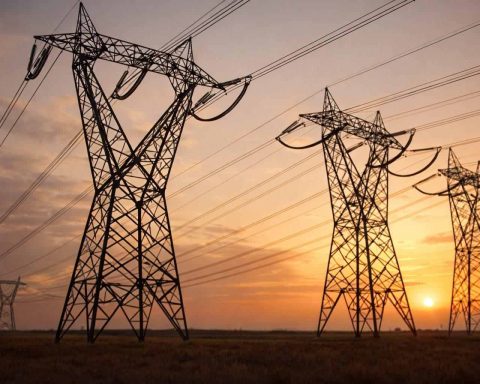

Utilities stocks slip ahead of Fed decision as Winter Storm Fern tests the grid

U.S. utility stocks fell Friday, with the Utilities Select Sector SPDR Fund down 0.35% to $42.56. Over 850,000 customers remained without power Sunday as outages spread and PJM Interconnection raised its demand forecast to a record 147.2 GW. The Department of Energy issued emergency orders for Texas and PJM grids. The Federal Reserve is expected to keep rates unchanged at its meeting Jan. 27–28.