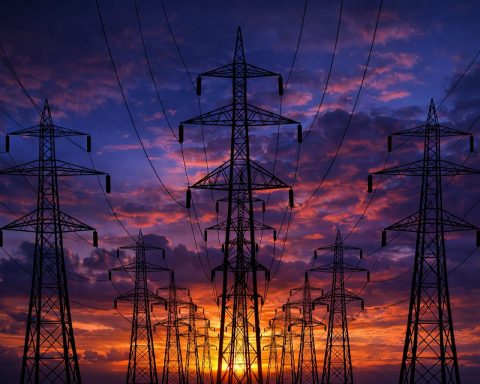

Utilities Stocks Outlook for 2026: AI Data Center Demand, Rate Cuts, and the New Power-Grid Investment Cycle

U.S. electricity demand is projected to hit record highs in 2025 and 2026, driven by AI and data centers, according to the EIA. PJM capacity auction prices reached $333.44 per megawatt-day, with supply falling short by 6,600 MW. Georgia regulators approved a $16.3 billion plan for Georgia Power to boost capacity by 50% to meet data center needs.