TSMC stock forecast 2026: New U.S. China licence and Nvidia H200 push put targets in focus

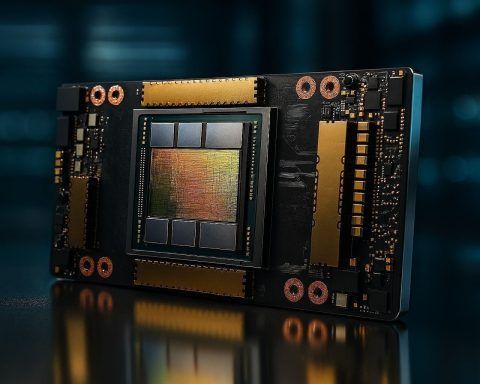

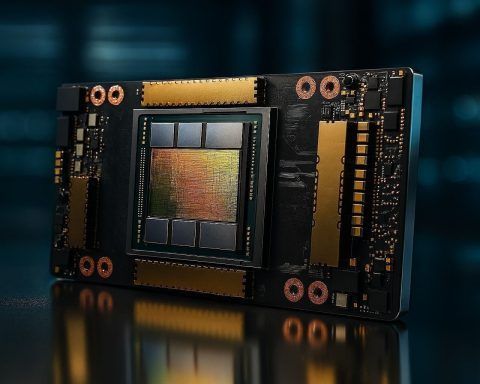

The U.S. granted TSMC’s Nanjing plant a new annual export licence for U.S. chipmaking tools, replacing an expired waiver. Sources said Nvidia has asked TSMC to ramp up H200 AI chip production for China in 2026, with work starting in Q2. TSMC’s ADRs last closed at $303.89, with analyst targets above that level. TSMC began 2-nanometre chip production in late 2025, with an enhanced version set for mass production in late 2026.