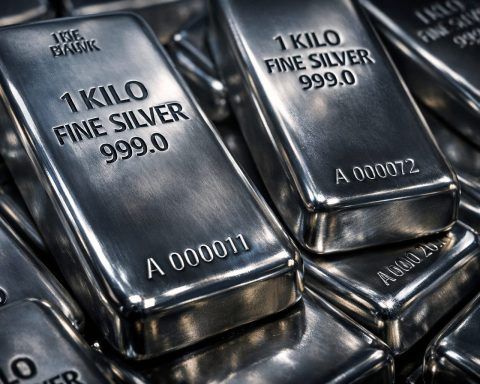

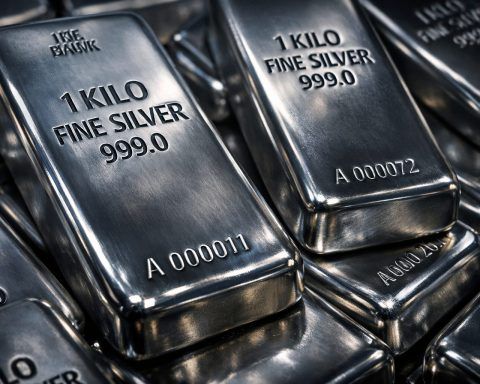

Silver Price Today (Dec. 24, 2025, 10:33 AM ET): Spot Silver Near $71 After Record $72.70 Surge — Latest News, Forecasts, and XAG/USD Analysis

Silver hit a record $72.70 per ounce early December 24 before retreating to $71.22 (ask) at 10:33 AM ET, with a bid of $69.74, according to APMEX. The 24-hour change stood at -$0.51 (-0.71%) as thin holiday trading widened spreads and amplified swings. Reuters cited Fed rate-cut expectations and a weaker dollar as key drivers. Silver remained above $70 despite the sharp intraday reversal.