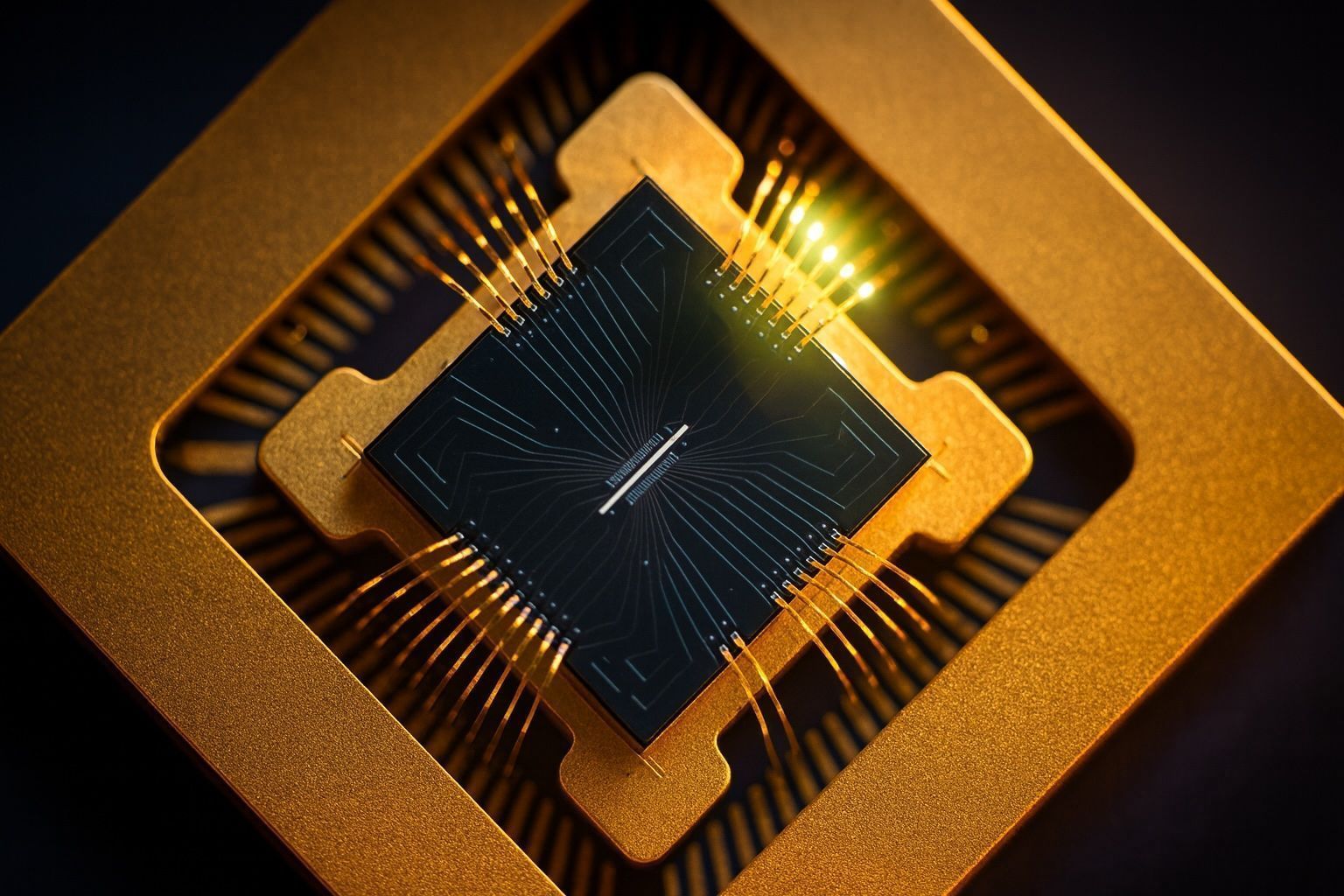

Quantum Leap: D-Wave (QBTS) Stock Skyrockets 2000% Amid Fed Rate Cuts and AI-Fueled Quantum Breakthroughs

D-Wave Quantum (NYSE: QBTS) shares surged 170% year-to-date and over 2,000% in the past year, closing at $26.88 on Sept. 19 after an 11.9% jump. The rally followed a Federal Reserve rate cut and D-Wave’s launch of its Advantage2 quantum system. Q2 revenue rose 42% to $3.1 million, but net losses widened to $167 million due to one-time charges. The company’s cash balance reached a record $819 million as of June 30.