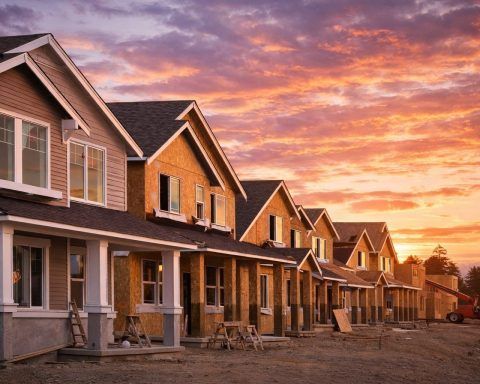

Opendoor Stock (OPEN) Ends Week Near $6 as Housing Data and Fed Minutes Loom: Latest News, Forecasts, and What to Watch Before Monday’s Open

Opendoor shares closed Friday at $6.01, down about 4% on heavy volume, with after-hours quotes near $5.94. The stock’s meme-driven rally has cooled in December, and no major new company announcements surfaced over the weekend. Investors await housing data and the Dec. 30 release of FOMC minutes. U.S. markets remain near record highs but face thin year-end liquidity.