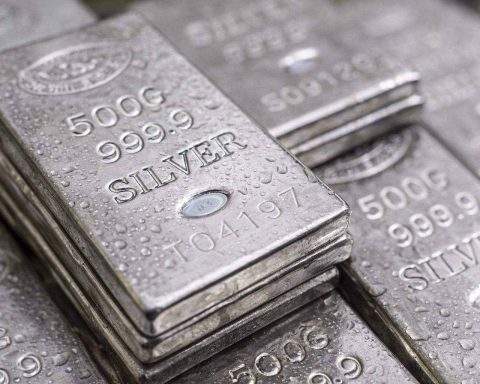

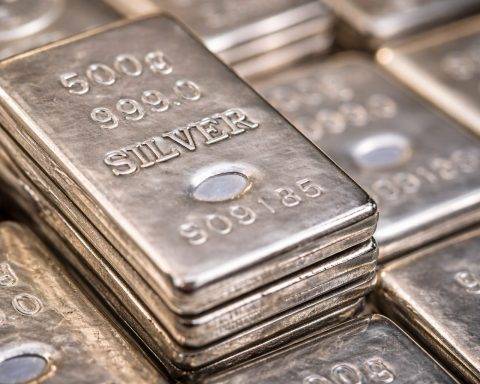

Silver price today: XAG/USD jumps near $94 and SLV rallies — what traders watch next week

Spot silver jumped 5.9% to $93.54 an ounce by midday in New York, rebounding after Thursday’s drop as investors sought safe havens amid Middle East tensions and falling U.S. Treasury yields. The U.S. dollar strengthened after January producer prices beat forecasts. U.S. silver futures rose 7.5% to $94.11. The iShares Silver Trust ETF gained 5% to $84.66.