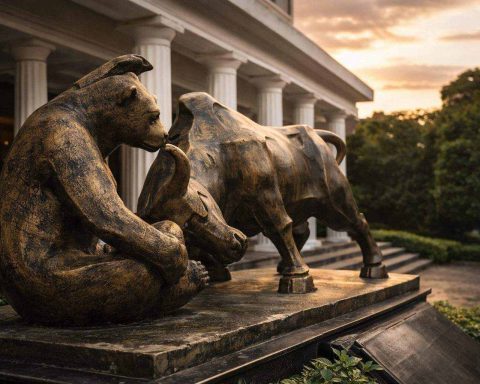

EGX30 slides 3% into the weekend as geopolitics bites; Egypt stocks face a Sunday test

Egypt’s EGX30 index closed Thursday down 2.98% at 50,667.67 points, with trading value near 5.6 billion pounds, marking its sharpest drop since June amid regional jitters over U.S.-Iran tensions. Small- and mid-cap benchmarks also fell around 3%. The market reopens Sunday, with focus on Commercial International Bank’s upcoming shareholder meeting.