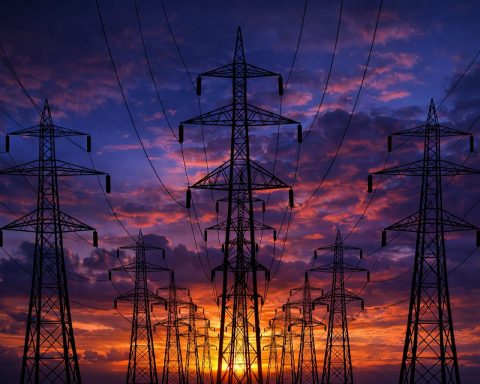

Caterpillar (CAT) Stock Today: Latest News, Analyst Forecasts, and 2026 Outlook as AI Power Demand Meets Tariffs and Legal Risk

Dec. 20, 2025 — Caterpillar, Inc. (NYSE: CAT) has spent much of 2025 acting like two stocks at once: the classic “global growth proxy” tied to construction, mining, and infrastructure—and, increasingly, a surprise beneficiary of the AI boom through power-generation equipment demand from data centers. As of the latest available quote on Dec. 20, 2025, Caterpillar shares were around $576. That price sits at the center of a fast-moving narrative: record backlog and AI-linked power demand on the bullish side, versus tariffs, cyclical end markets, valuation debates, and a fresh legal overhang on the bearish side. What’s moving Caterpillar stock