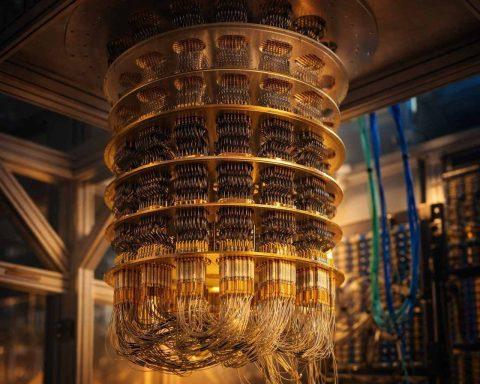

IonQ, Rigetti and QUBT move: what’s driving quantum computing stocks into next week

New York, Jan 17, 2026, 13:22 EST — Market closed. Rosenblatt Securities analyst John McPeake kicked off coverage on Rigetti Computing and Quantum Computing Inc, handing both Buy ratings, Barron’s reported. The quantum computing sector stays under the spotlight, despite ongoing skepticism about extended timelines and scant near-term revenue. “Rigetti does indeed need to get their error rates down to be more competitive,” McPeake noted. (Barron’s) Quantum computing uses quantum bits, or qubits, to tackle problems beyond the reach of classical computers. But in the market, that potential is tough to value. Stocks in this space usually move on technical