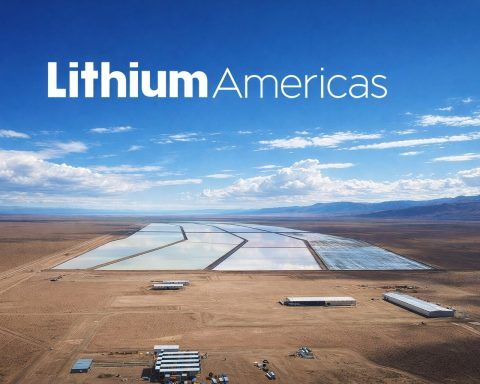

Lithium Americas (LAC) Stock on December 10, 2025: Government Money, TSX Index Debut and a Long Road to Thacker Pass

On December 10, 2025, Lithium Americas Corp. traded at $5.17 in New York and C$7.31 in Toronto, with a market cap near $1.3 billion and no reported revenue. The company will be added to the S&P/TSX Composite Index before trading opens on December 22. U.S. Department of Energy holds a 5% equity stake in Lithium Americas and its Thacker Pass joint venture. The stock remains volatile, missing recent earnings expectations.