New York, Feb 14, 2026, 14:04 EST — Market closed

- CEO Michael Intrator reported selling shares as part of a pre-set trading plan

- CRWV ended the session 0.3% higher at $96.04. U.S. markets will be closed Monday for Presidents Day.

- Nvidia is on the calendar for Feb. 25, with CoreWeave following up with its earnings call a day later, Feb. 26.

CoreWeave Inc (CRWV.O) CEO Michael Intrator unloaded roughly $7.7 million in stock through a Rule 10b5-1 plan, according to a filing Friday. Shares ended the day at $96.04, up 0.3%, after trading in a range from $91.11 to $100.67. SEC

This disclosure hits just as U.S. equity markets close Monday for Washington’s Birthday, slicing a day off the trading week. Investors now have less time to absorb fresh filings and earnings headlines ahead of the next session. New York Stock Exchange

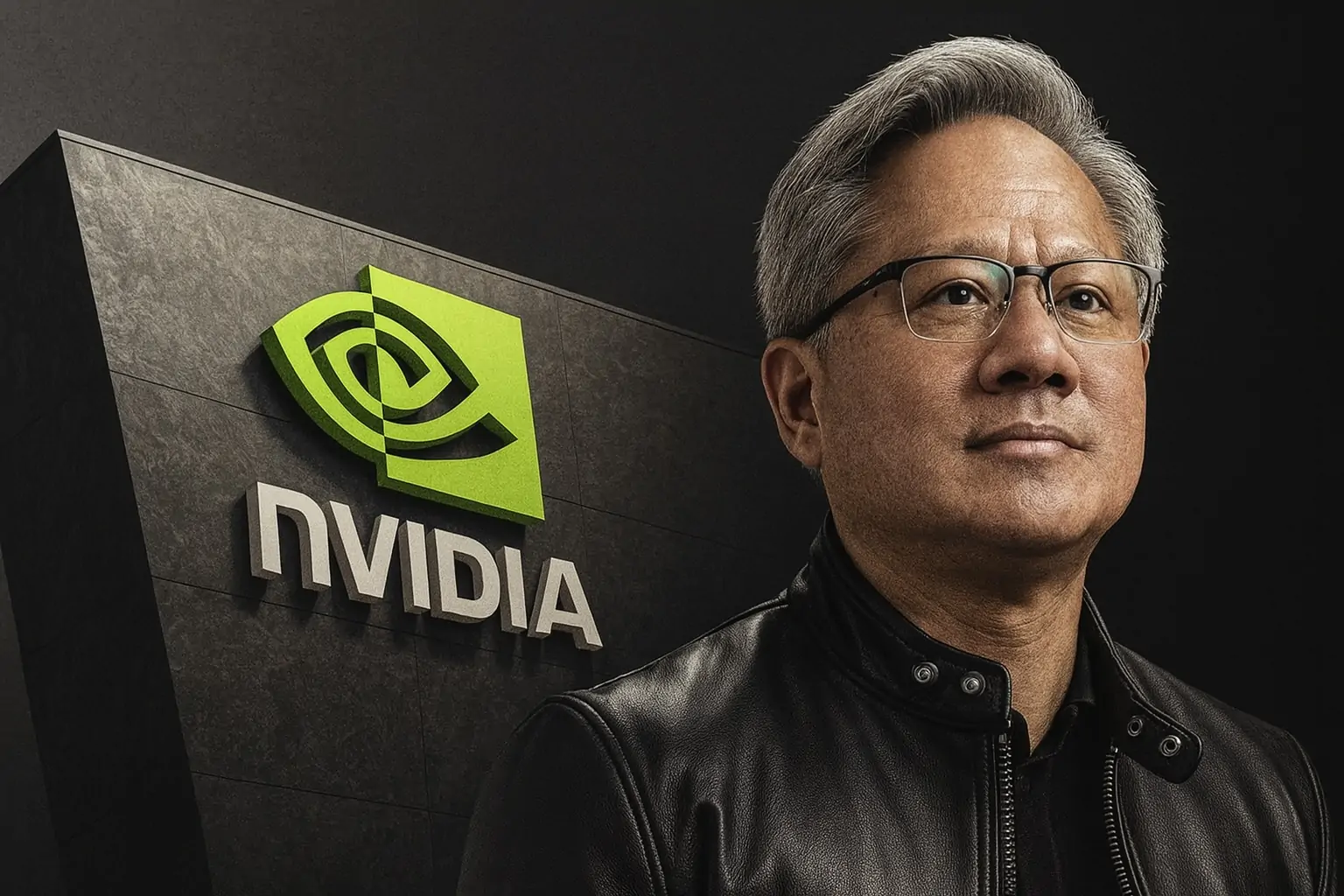

Two big dates on the AI infrastructure calendar: Nvidia’s earnings call lands Feb. 25, with CoreWeave set to report Q4 and full-year numbers a day later, at 5 p.m. ET on Feb. 26. Fresh figures from both could shake up views on appetite for high-end AI hardware—and provide a read on data-center rollout velocity. NVIDIA Newsroom

According to Intrator’s Form 4, he sold shares on February 11, with prices between roughly $89.29 and $97.10 each. The filing notes these trades stemmed from a plan set up on May 23, 2025. Following the moves, his direct Class A stake stood at approximately 5.76 million shares.

Jane Street Group disclosed in a Schedule 13G/A filed Thursday that it held 19,738,788 shares of CoreWeave, amounting to a 5.1% stake as of Dec. 31. The 13G filing signals the firm sees itself as a passive investor, rather than looking to gain control. SEC

CoreWeave handed out an equity grant to a top exec this week. Chief Revenue Officer Jonathan Jones logged 64,301 restricted stock units — stock-based compensation that vests gradually — in a Form 4 submitted Thursday. SEC

CoreWeave, ever since its March 2025 debut, has acted as a levered play on AI infrastructure demand, riding Nvidia’s coattails for scale. Back in January, Nvidia disclosed a $2 billion equity stake in CoreWeave at $87.20 a share as the pair deepened collaboration on “AI factories” and fresh data center buildouts; Nvidia CEO Jensen Huang billed it as “the largest infrastructure buildout in human history.” CoreWeave’s Intrator, for his part, said the tie-up “underscores the strength of demand we are seeing across our customer base.” NVIDIA Newsroom

The setup heading into next week doesn’t look clean. Nvidia dropped 2.2% in the last session, while Applied Digital, which operates data centers linked to AI expansion, slipped 2.5%. The broader “AI trade” is still quick to react to changes in risk appetite.

For CoreWeave bulls, insider selling and a swirl of legal issues pose real risks to the thesis—especially with a stock swinging so wildly during the day. Court-tracking firms list a securities suit, Masaitis v. CoreWeave, Inc., et al., filed in New Jersey federal court on Jan. 12. Law firm alerts out this week put a March 13 deadline on investors aiming for lead-plaintiff. PacerMonitor

Markets are shut Monday, leaving CoreWeave’s real price test for Tuesday, Feb. 17, when trading picks back up. Not long after, focus shifts: Nvidia’s up Feb. 25, and then CoreWeave reports on Feb. 26. For investors hoping for updates on AI demand and what it takes to build out infrastructure, those are the two dates that matter.