New York, Jan 25, 2026, 13:19 ET — Market closed

- The Health Care Select Sector SPDR Fund (XLV) dropped 0.5% on Friday, closing at $157.48.

- Eli Lilly dropped 2.1%. Johnson & Johnson and UnitedHealth saw modest gains.

- Traders enter Monday focused on signals from obesity-drug demand and a packed earnings calendar.

Healthcare stocks finished last week lower, with XLV — the ETF tracking major U.S. healthcare companies — slipping 0.5% by Friday’s close. Eli Lilly weighed on the sector, though some of the bigger names in the index managed to hold up.

The drop followed a choppy week for the broader U.S. market, rattled by earnings reports and geopolitical tensions. Investors were quick to unwind crowded bets. “We’re feeling pretty good, but mindful we might have some significant twists and turns,” said Jason Blackwell, chief investment strategist at Focus Partners Wealth. Reuters

The timing is crucial as upcoming sessions bring a series of catalysts capable of pushing healthcare stocks either way — from insurance earnings to drug-demand figures now seen as quick gauges of growth. Investors are also preparing for a week packed with central bank decisions and major earnings that could heavily influence risk appetite. Reuters

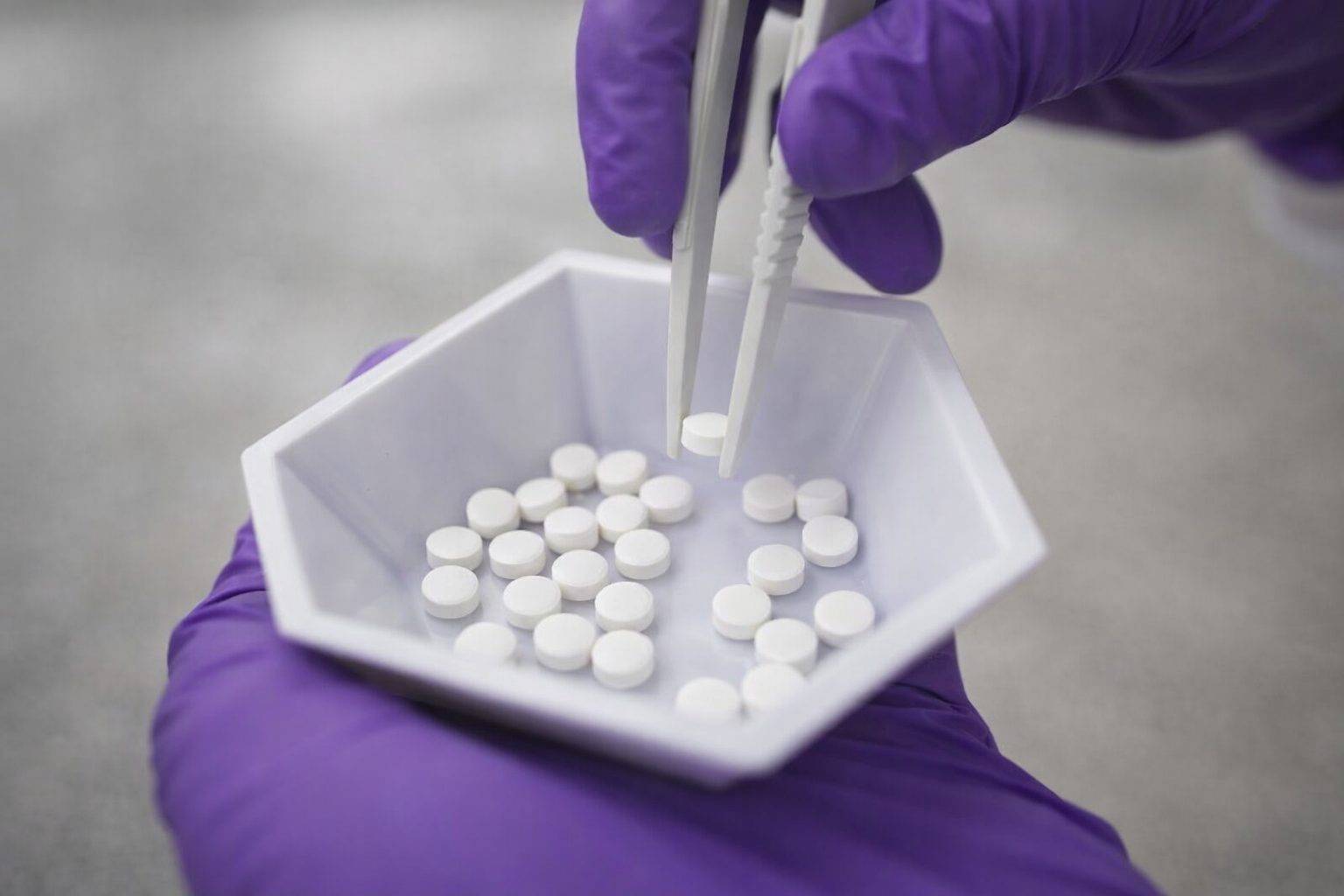

The race in GLP-1 obesity drugs — which mimic gut hormones to suppress appetite — is heating up as investors focus on early prescription numbers for a reality check. Novo Nordisk’s Wegovy pill hit 18,410 U.S. prescriptions in the week ending Jan. 16, Reuters reported. Jefferies analyst Akash Tewari called this early launch “directionally encouraging” for Eli Lilly’s experimental pill orforglipron, which is up for an FDA decision by April. Reuters

Regulatory concerns lingered as the FDA connected a multi-state infant botulism outbreak to ByHeart’s formula, tracing it back to whole-milk powder from a supplier. The company has since recalled all its infant formula products. The agency confirmed its investigation is still underway. Reuters

Policy noise flared up again in Washington over the weekend when the U.S. Department of Health and Human Services reinstated roughly $5 billion in public health grants to states, mere hours after pausing the funding, Bloomberg News reported, citing an HHS spokesperson. Reuters

The World Health Organization expressed regret over the United States’ move to pull out of the U.N. health agency, injecting fresh uncertainty for investors who monitor funding flows, coordination efforts, and disease response strategies. Reuters

But the setup comes with clear risks. Prescription momentum often slows after early adopters have gone through, and the success of new obesity treatments depends heavily on whether insurers, employers, or patients foot the bill. Policy developments tend to hit in fits and starts, and when they do, healthcare prices can shift rapidly.

Traders are set to focus on UnitedHealth’s earnings Tuesday and Regeneron’s report Friday, scanning for clues on whether demand and pricing will stay firm heading into 2026. Several other healthcare names will also draw attention. Kiplinger

Until then, the sector heads into Monday’s reopening with the usual checklist: obesity-drug demand, insurer updates on costs, and any new moves from regulators or policymakers that might shift sentiment quickly.