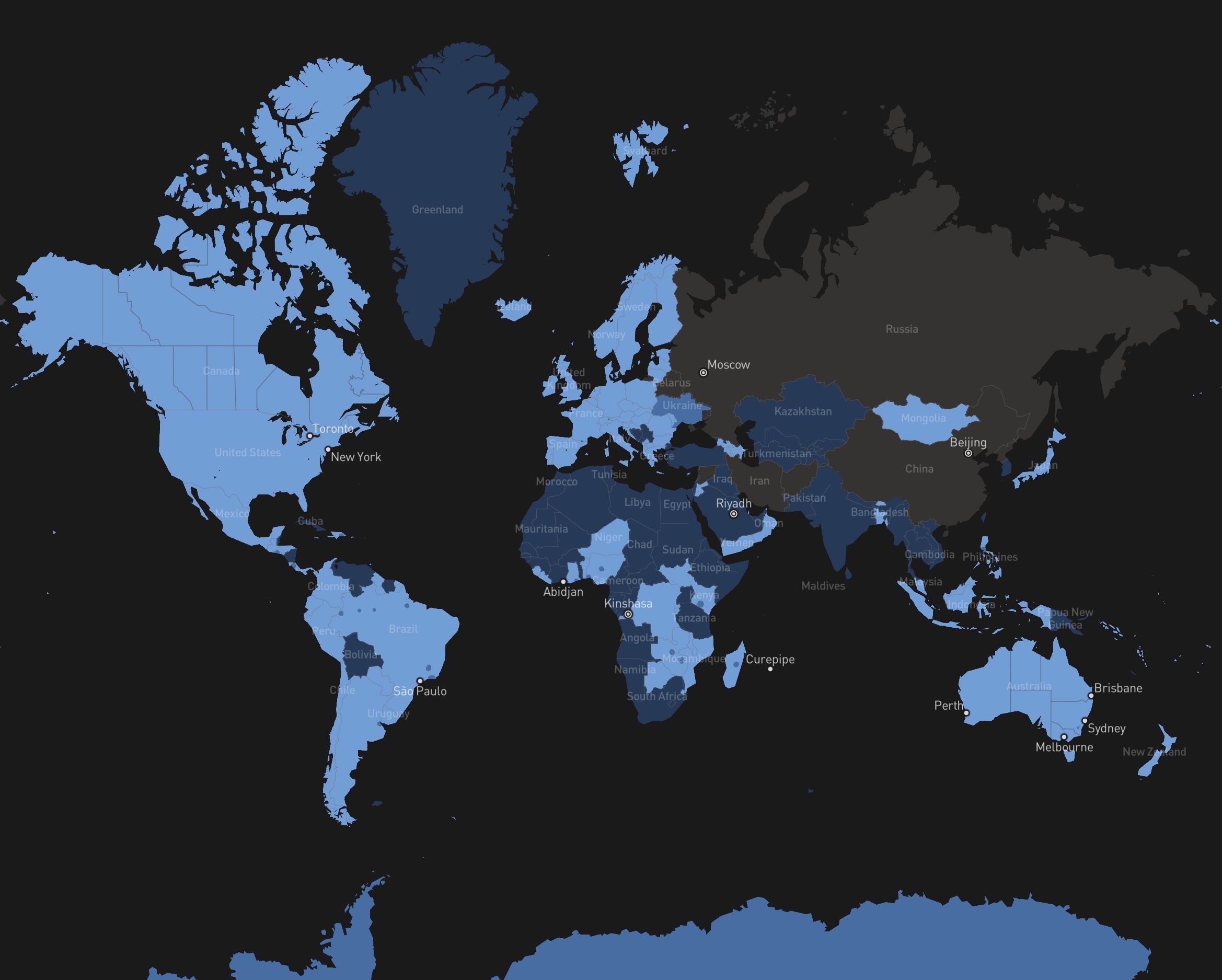

Starlink Global Availability and Impact Report

Starlink is available in over 100 countries as of mid-2025, spanning North America, Europe, Asia, Africa, Oceania, and parts of South America. As of late 2024, Starlink had surpassed 4 million subscribers. Starlink offers five service types: Residential, Roam, Business (Priority), Maritime, and Aviation. Typical speeds range from about 50 Mbps to 150+ Mbps, with most users above 100 Mbps under good conditions, and latency around 20–50 ms. Monthly pricing ranges from about $90–$120 in well-connected markets, with discounts to roughly $30–$50 in developing regions. The United States was the first to receive Starlink, with public beta in mid-2020 and