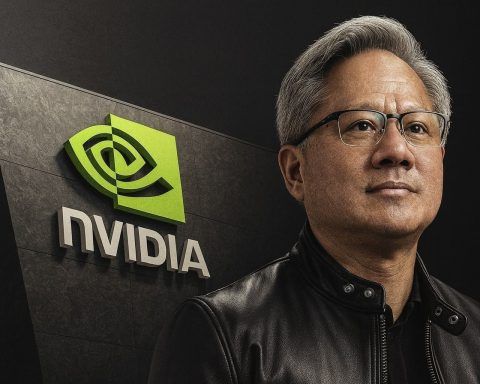

Nvidia CEO Jensen Huang on Joe Rogan: AI Jobs, National Security and Trump Export‑Control Talks

Published December 3, 2025 On a single news‑packed day, Nvidia CEO Jensen Huang managed to dominate the technology, business and political conversation. A new episode of The Joe Rogan Experience featuring Huang dropped, Axios published excerpts in back‑to‑back stories, Washington reported that U.S. President Donald Trump met with the Nvidia chief to talk export controls, and fresh analysis continued to surface about Huang’s internal push to “automate every task” with AI at Nvidia. TechRadar+3Axios+3Axios+3 Taken together, December 3, 2025 offers the clearest snapshot yet of how one of the most powerful figures in AI sees the future of work, national security and Big