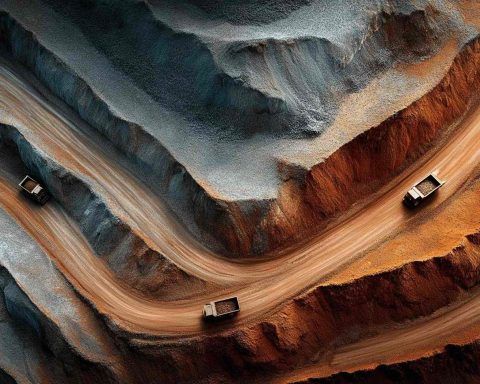

Southern Copper (SCCO) Skyrockets on Copper Price Boom – Key Facts & Outlook

Southern Copper Corporation Overview and Market Outlook as of September 24, 2025 SCCO Stock Performance in Late September 2025 Southern Copper’s stock has been on a tear in recent weeks, climaxing with a sharp rally around September 24, 2025. On that day, SCCO surged roughly 8–9%, hitting a new 52-week high of about $117–$121 per share ca.investing.com ainvest.com. This jump was the stock’s largest single-day gain in over a year ainvest.com. The rally coincided with a spike in copper prices, underscoring Southern Copper’s sensitivity to the commodity. Year-to-date, SCCO is up roughly 27%, reflecting robust investor confidence and far outpacing