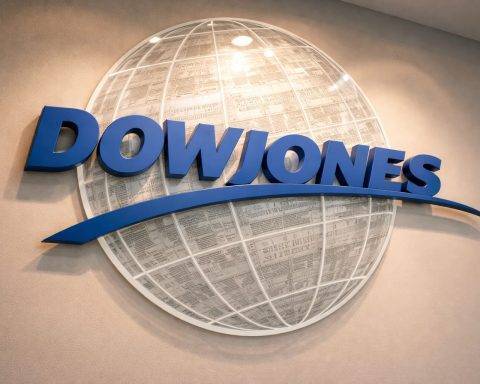

Dow Jones futures edge up as IBM pops and Microsoft drops before inflation data

Dow E-mini futures rose 42 points early Thursday as IBM jumped 8.3% on strong earnings and Microsoft fell 6.4% amid doubts over AI spending. Meta surged 7.9%, Tesla gained 2.9%. Investors await jobless claims and PCE inflation data at 8:30 a.m. ET, with Apple set to report earnings after the close. The Dow closed Wednesday up 12.19 points at 49,015.60.