German Stock Market Today, 18 November 2025: DAX 40 Falls Over 1% as Bank Risks, AI Bubble Fears and Stablecoin Push Shape Frankfurt Session

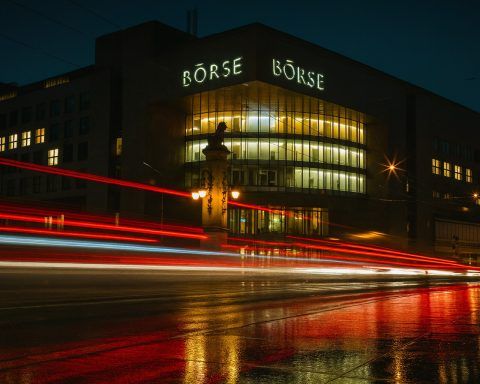

Germany’s blue‑chip DAX 40 index closed sharply lower on Tuesday, 18 November 2025, as the Frankfurt Stock Exchange was hit by a global risk‑off wave, fresh warnings from the European Central Bank (ECB) about bank vulnerabilities, and ongoing concerns over an “AI bubble” in technology stocks. By the close of Xetra trading at 17:30 CET, the DAX finished at 23,335.07 points, down 1.08% from Monday’s close of 23,590.52, after trading in a relatively tight intraday range between about 23,230 and 23,365 points. Investing.com DAX 40: Weak Open, Heavy Session, Lower Close Trading on Xetra, Deutsche Börse’s fully electronic order book