AI Megatrends 2025: The Next Wave Is Here—Why Data‑Center Power, AI Agents & Edge Devices Could Reshape Markets (and Portfolios) Now

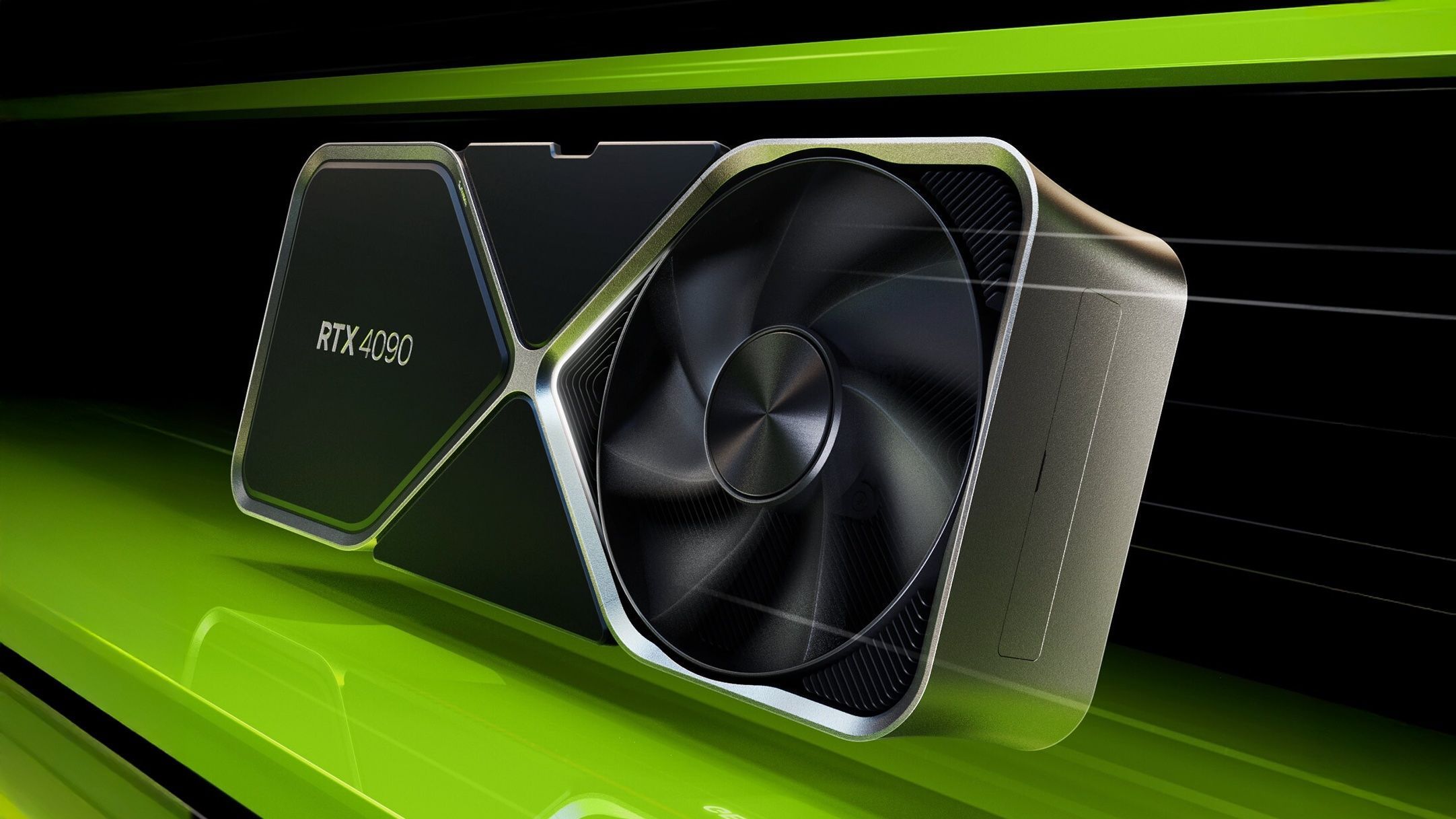

Key facts (what changed this week) The three AI megatrends shaping the next phase 1) Hyperscale compute + energy: AI “super‑factories” What’s happening. Frontier models, agents and video‑native AI are pushing demand from chips to power, cooling, memory and networking. The Stargate program alone is racing toward multi‑gigawatt campuses; Nvidia committed up to $100B in supply/investment to OpenAI, underscoring how intertwined vendors and model labs have become. Reuters+1 Power & water constraints. PJM’s service area is straining under data‑center load, prompting demand‑response pacts (e.g., Google) and federal fast‑track permitting for plants and transmission. Expect siting to follow available gigawatts and