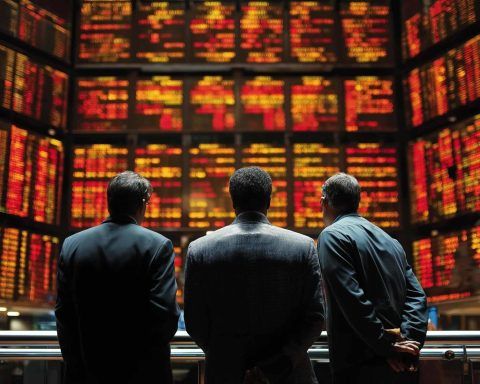

Asia Stock Market Today: Fed Nerves, China Policy Signals and Trade Jitters Drag Region Lower (9 December 2025)

Asian stocks mostly fell Tuesday as investors awaited a US Fed rate cut and digested cautious policy signals. Hong Kong’s Hang Seng dropped up to 1.2%, Shanghai slipped, and India extended losses. Japan’s Nikkei edged up 0.2%, bucking the trend despite recent earthquake concerns. Australia, South Korea, and Taiwan also traded lower.