Top U.S. Stock Gainers Today (Dec. 10, 2025): ASPC, ENVB, BDRX, HSPO, BRZE Surge Ahead of Fed Decision

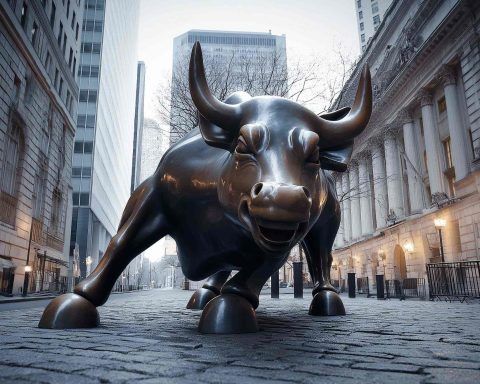

Published: December 10, 2025 — U.S. pre‑market sessionAll data and news current as of early U.S. trading hours on Dec. 10, 2025. Fed Day Starts Quiet for Indexes, Wild for Individual Stocks Wall Street is waking up to a classic “calm on the surface, chaos underneath” kind of Fed day. S&P 500, Nasdaq 100, Dow Jones and Russell 2000 futures are only fractionally lower or higher in pre‑market trading, with moves generally within a few tenths of a percent as investors wait for the Federal Reserve’s final rate decision of 2025.Yahoo Finance+3StockAnalysis+3Morningstar+3 Markets widely expect another 25‑basis‑point cut, but the