OpenAI and Jony Ive’s ‘Elegantly Simple’ ChatGPT Device Heats Up as Apple Loses Dozens of Top Engineers

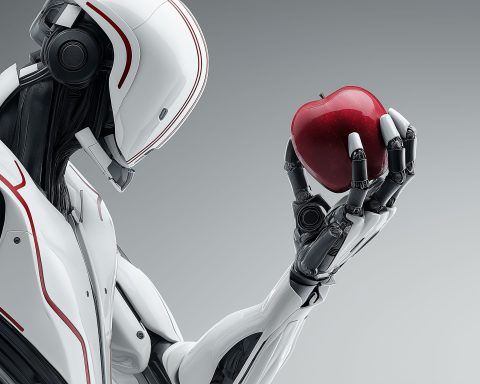

Published: November 24, 2025 OpenAI’s long‑rumored hardware push with legendary Apple designer Jony Ive is no longer just vapor. On the same day that Sam Altman and Ive publicly teased “elegantly simple” AI devices already in prototype, multiple reports say OpenAI has poached more than 40 Apple hardware engineers in about a month — a talent raid that’s starting to look like a full‑blown front in the AI hardware war between OpenAI and Apple. India Today+3Axios+3The Times of India+3 A stealth AI device that’s “elegantly simple” — and nearly ready At Emerson Collective’s Demo Day ’25 in San Francisco last