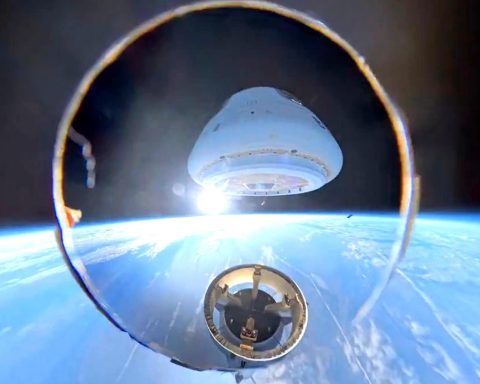

Explosive Tech Blitz: AI Bubble Warning, Amazon’s Echo Refresh, Starlink Launch & More (Sept 29–30, 2025)

Investors warn the AI-driven stock rally may be overheating, with Carthage Capital’s Stephen Wu urging caution as tech giants trade at 22× revenue. OpenAI launched new ChatGPT safety features, including parental controls and a “GPT-5” safety model, after reports of harmful chatbot behavior. California enacted SB 53, requiring AI developers to share technical details and risk assessments.