Top Stock Losers Today (Dec. 12, 2025): SanDisk, Broadcom and Oracle Sink as AI Trade Takes a Hit After the Close

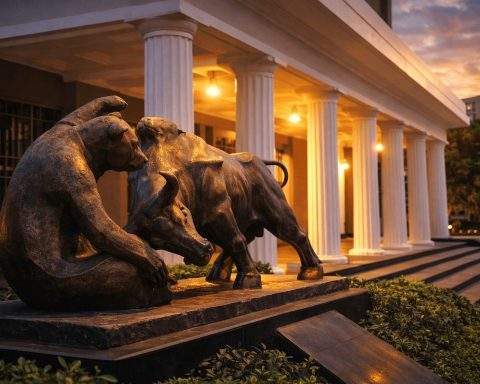

U.S. stocks fell Friday, with the S&P 500 down 1.07% and the Nasdaq dropping 1.69% to its lowest close since Nov. 25. SanDisk plunged nearly 15%, Broadcom lost 11% after warning on margins, and Oracle extended its decline. Every stock in the Philadelphia semiconductor index dropped, sending the index down 5.1%. Investors rotated out of AI and semiconductor shares amid margin and spending concerns.