Broadcom (AVGO) Stock Soars After $10B OpenAI AI Chip Deal – Analysts Raise Targets

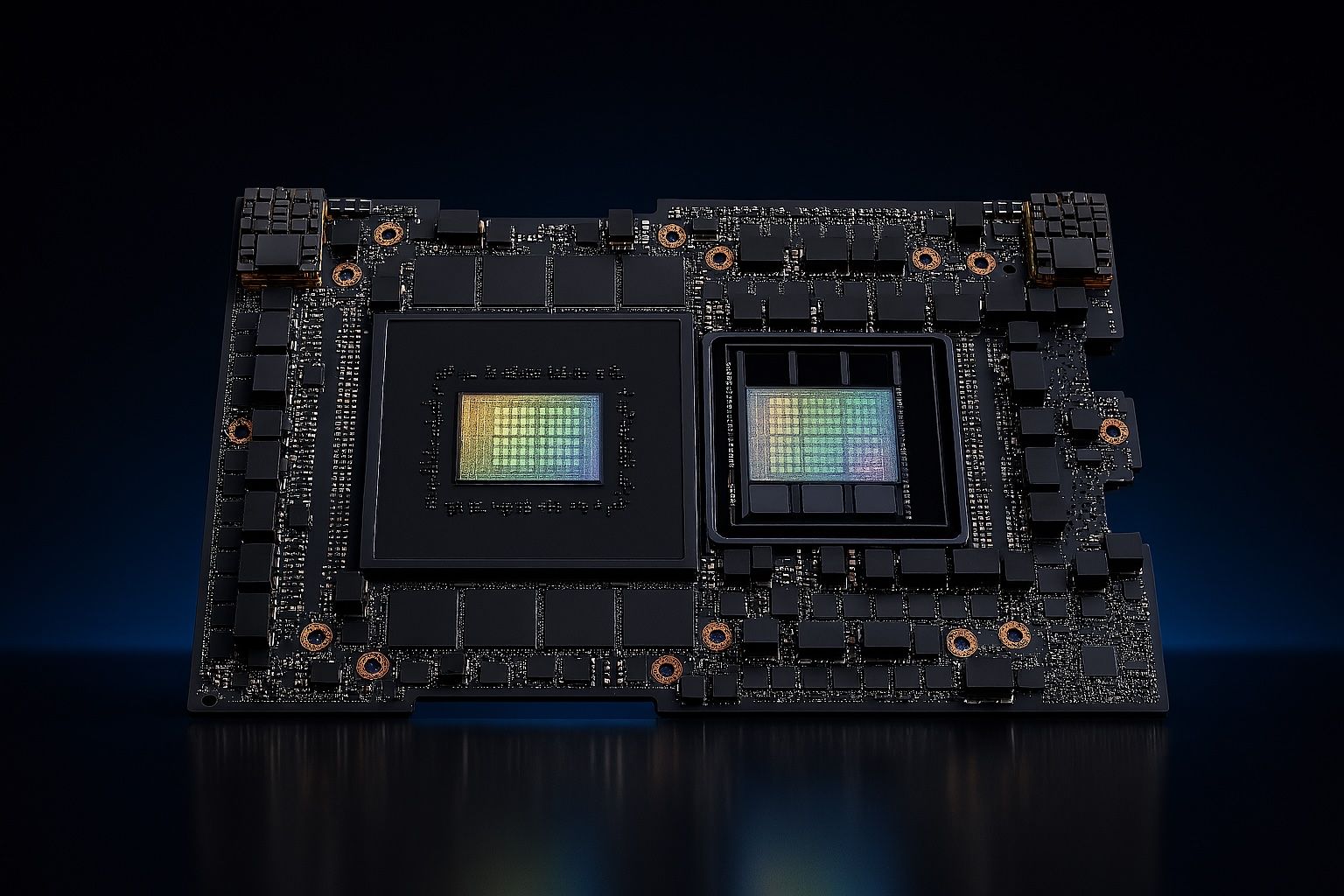

Stock Performance and Recent Movement Broadcom’s stock has surged dramatically in 2023–2025, fueled by the AI boom and strategic dealsts2.tech. After a 10-for-1 split in Feb 2024, retail interest surged along with its fundamentalsts2.tech. By Oct 2025, Broadcom’s market cap surpassed $1.5 trillionts2.tech. The share price peaked around $374 in early Sept 2025 (post-split), roughly double its level a year priorts2.tech. Even after an early-October dip (amid broader market volatility), AVGO remains up ~70% YTDts2.tech, far outperforming the S&P 500. Over the past week, the stock was volatile. On Oct 13 AVGO jumped +9.9%investing.com following the announcement of a new $10B