Google’s October 2025 Shockwave: AI Advancements, Big Bets & Alphabet’s Soaring Fortunes

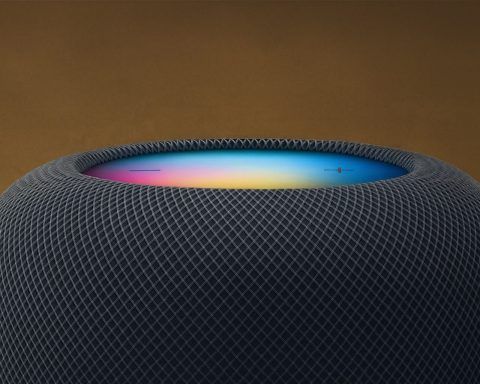

Alphabet will spin off its Verily life sciences unit and has laid off over 100 Google Cloud employees amid restructuring. In court, Google defended against a forced breakup of its ad tech business as regulators pressed for remedies. Google unveiled Pixel 10 phones with new AI chips and refreshed its Nest smart home line with Gemini AI. Alphabet’s stock neared a record high, briefly topping $3 trillion in market value.