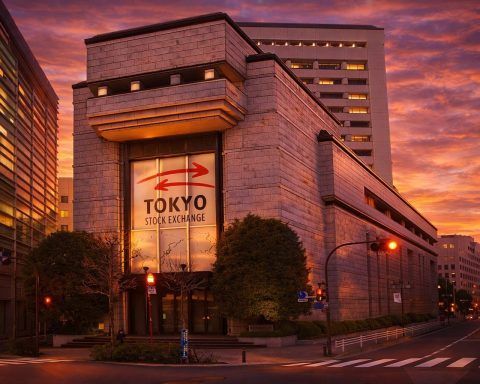

Nikkei 225 Ripped 3% as TOPIX Hit a Record—But Traders Keep Staring at 157

The Nikkei 225 jumped 3.03% to 51,865 in Tokyo’s first 2026 session, with TOPIX up 2.01% at 3,477.52. Advantest and Tokyo Electron surged over 6% each, tracking U.S. chip gains. The yen weakened to 157.295 per dollar after BOJ chief Kazuo Ueda signaled more rate hikes. December factory data showed stabilization, fueling further buying.