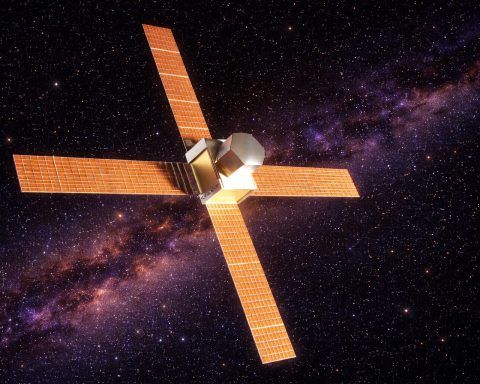

Space Forge sparks plasma on ForgeStar-1 in orbit, pushing semiconductors-in-space closer

Space Forge said it generated plasma aboard its ForgeStar-1 satellite, marking the first commercial, free-flying in-space manufacturing of its kind. The test, conducted on Dec. 31, demonstrated that key conditions for semiconductor crystal growth can be achieved and controlled autonomously in orbit. The company aims to produce high-performance semiconductor materials for power electronics and communications.