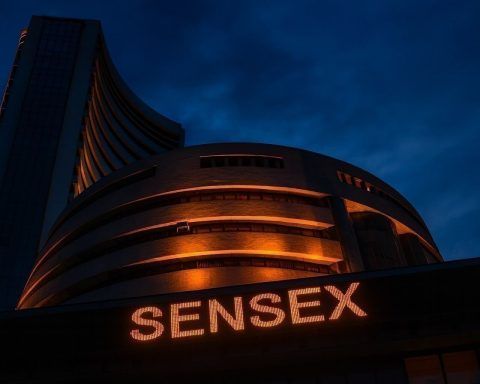

India Stock Market Today (16 December 2025): Sensex Drops 533 Points, Nifty Slips Below 25,900 as Rupee Hits Record Low — Outlook, Key Levels, and Stocks in Focus

Mumbai/New Delhi, December 16, 2025: Indian equities ended sharply lower on Tuesday as a fresh record low in the rupee, continued foreign selling, and uncertainty around the India–US trade deal kept risk appetite in check. The headline indices trimmed part of their intraday losses, but the tone remained defensive across sectors, with metals, private banks and IT among the key drags. Market close: Sensex, Nifty end over 0.6% lower The BSE Sensex closed at 84,679.86, down 533.50 points (–0.63%), while the NSE Nifty 50 settled near 25,860 (–0.64%), ending the session below the psychologically important 25,900 mark. mint+2NSE India+2 Intraday, the Sensex fell to around 84,718, and Nifty dipped below 25,900, before paring losses into