UK Inflation Falls to 3.2% in November 2025, Fueling Bank of England Rate Cut Expectations

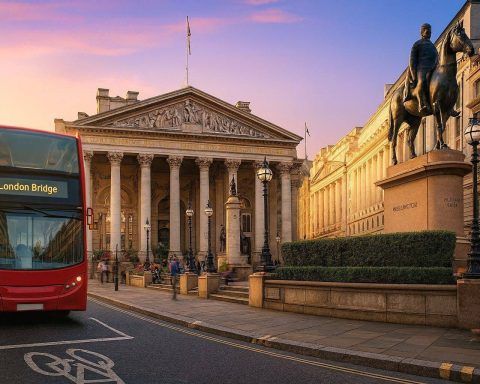

UK inflation cooled more sharply than forecast in November, strengthening market expectations that the Bank of England (BoE) will cut interest rates at its December decision. Figures released by the Office for National Statistics (ONS) on Wednesday, 17 December 2025 show the Consumer Prices Index (CPI) inflation rate fell to 3.2% in the 12 months to November, down from 3.6% in October. On a month‑to‑month basis, CPI fell by 0.2%—a notable shift for a period that often includes pre‑Christmas price changes. Office for National Statistics The cooler‑than‑expected inflation report lands just one day before the BoE publishes its Monetary Policy