FTSE 100 Today: London Stocks Slide as Global Tech Sell‑Off Deepens – UK Stock Market Update (18 November 2025)

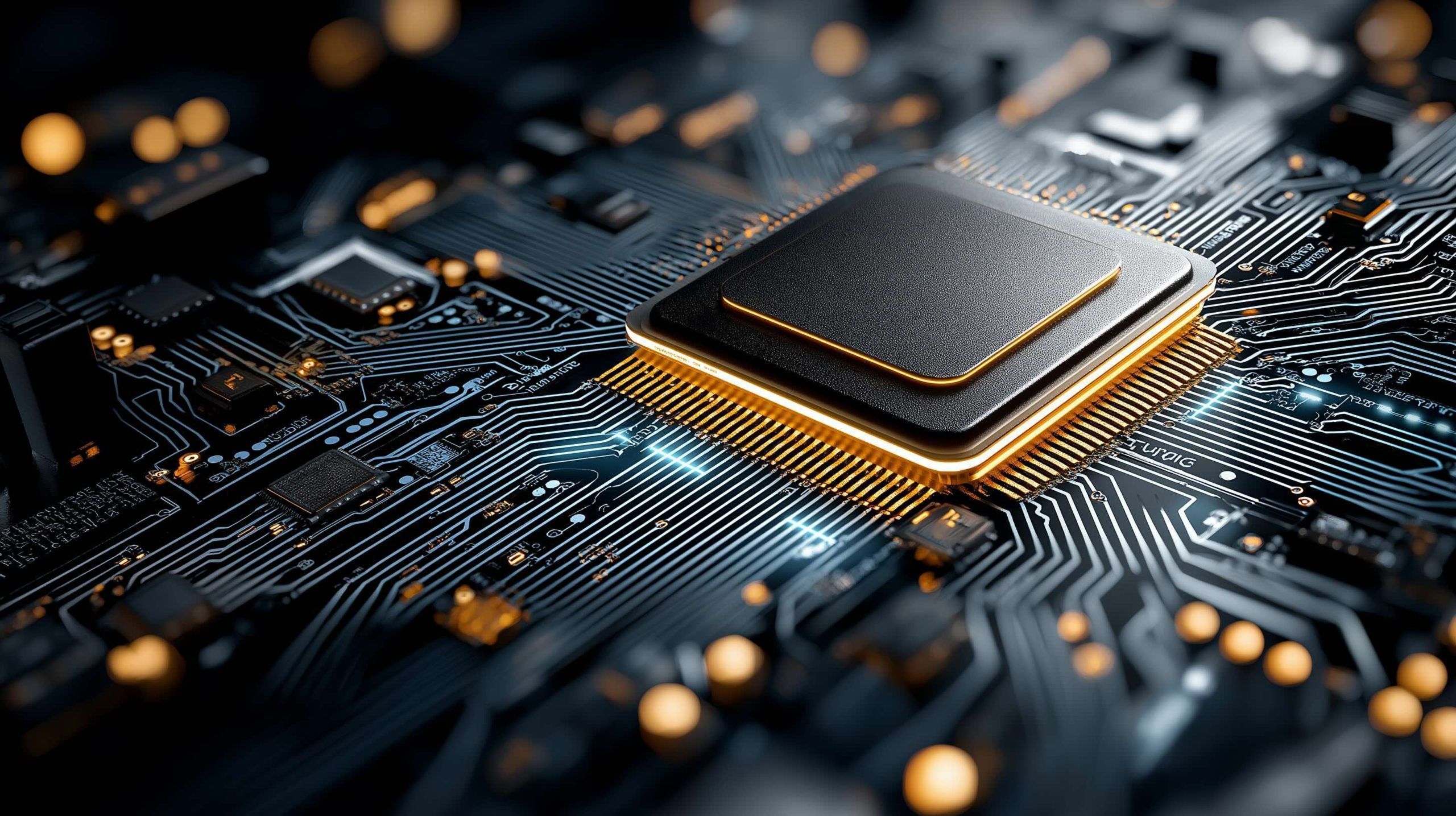

London’s FTSE 100 fell again on Tuesday 18 November 2025, as a global “risk‑off” wave driven by tech valuation worries, fading hopes of a near‑term US rate cut and a sharp drop in Bitcoin spilled into the UK stock market.