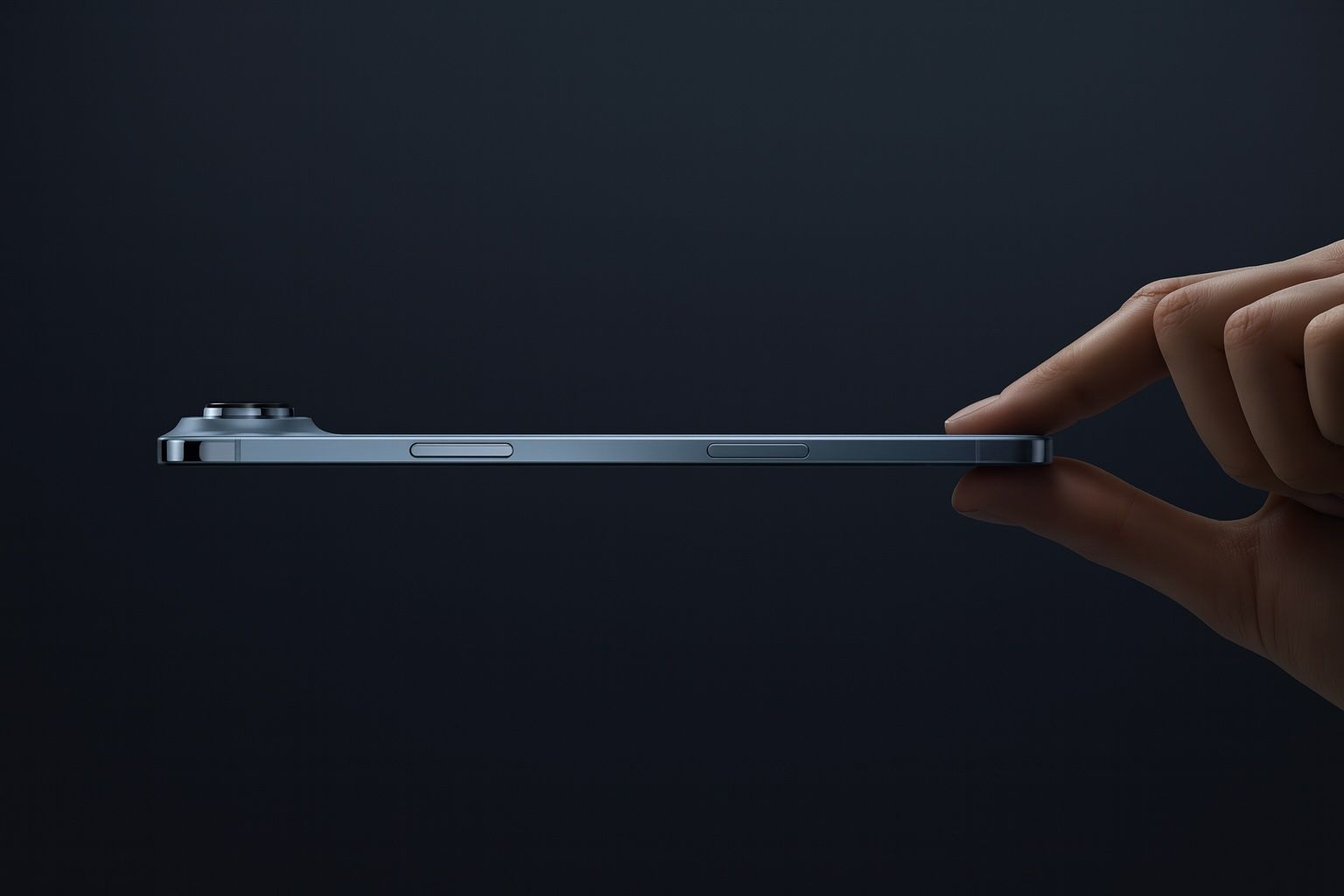

Samsung’s $649 Galaxy S25 FE Shines with Flagship AI – A Deep Dive vs S25 Ultra, Pixel 9, iPhone 16 & More

Samsung launched the Galaxy S25 FE at IFA 2025 on Sept. 4, pricing it at $649.99 with immediate availability and six months of free Google AI Pro service. The phone features a 6.7-inch AMOLED display, Exynos 2400 chip, triple rear cameras with AI enhancements, and runs Android 16 with Galaxy AI tools. Samsung promises seven years of software and security updates.