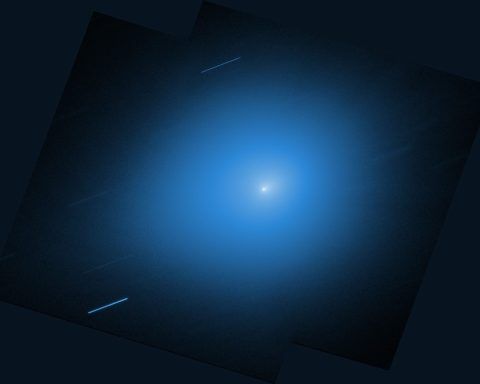

Comet 3I/ATLAS Today (Dec. 26, 2025): Wobbling Jets Detected in a Rare Sun-Facing Tail as the Interstellar Visitor Departs

Dec. 26, 2025 — Comet 3I/ATLAS is already on its way out of our neighborhood, but it’s still managing to surprise astronomers on the way to the cosmic exit ramp. Today’s coverage centers on a fresh scientific twist: researchers have identified wobbling jet structures inside an even rarer feature—an apparent tail that points toward the Sun, not away from it. The Indian Express If you’ve been following the saga, this is the part where the universe reminds us it has a sense of humor: the comet is leaving, fading, and getting harder to observe from Earth—yet the data it already