UK Stock Market Today, 24 November 2025: FTSE 100 Extends Winning Streak as Fed Cut Bets, Ukraine Peace Hopes and Budget Jitters Collide

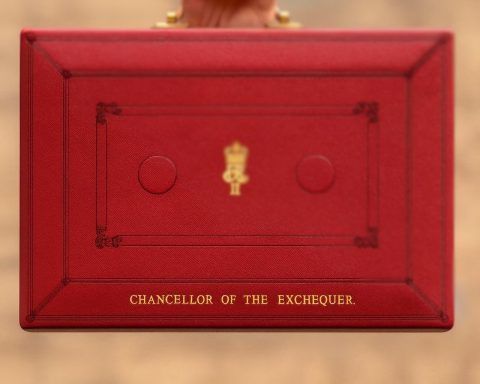

The UK stock market kicked off the week in positive territory on Monday 24 November 2025, with the FTSE 100 extending its rebound for a third straight session as investors juggled optimism over US interest-rate cuts, tentative progress towards a Ukraine peace framework, and mounting anxiety ahead of Rachel Reeves’s high‑stakes Autumn Budget on Wednesday. London South East+2IG+2 FTSE 100: Modest Gains, Big Cross‑Currents At the London market open, the FTSE 100 climbed about 0.4% to 9,579.72, while the FTSE 250 rose 0.5% to 21,459.57and the AIM All‑Share added 0.2% to 737.15, according to Alliance News data carried by London South East. London South East As the session progressed, the