Amazon’s Europe-only AWS cloud launch puts cloud computing stocks in focus before Tuesday’s open

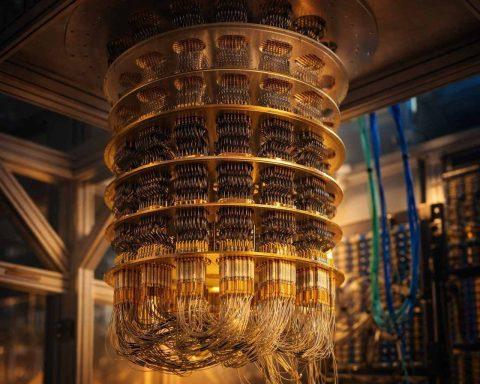

NEW YORK, Jan 17, 2026, 13:45 EST — Market closed Cloud computing stocks enter the extended U.S. weekend under fresh scrutiny after Amazon’s AWS rolled out a cloud service based solely in Europe. The move targets clients worried about data access and legal jurisdiction. (Reuters) The term “sovereign cloud” — which refers to keeping data and control within a given jurisdiction — is shifting from a niche preference to a must-have for certain regulated buyers. Investors are also pressing tougher questions about whether massive AI investments will deliver returns quickly enough. Markets shut Monday for Martin Luther King Jr. Day,