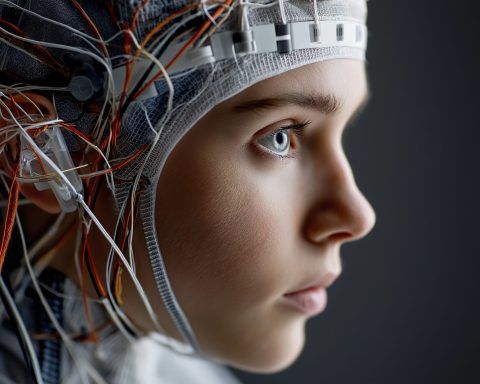

The Benefits of Brain-Computer Interfaces for Cognitive Enhancement: What 2025’s Breakthroughs Mean for Memory, Attention, and Communication

In 2025, companies and research groups reported new clinical milestones for brain-computer interfaces, expanding their use in restoring speech, memory, and communication. UNESCO in November adopted the first global ethics framework for neurotechnology, citing both medical potential and risks of misuse. Policymakers are drafting rules for neural data and mental privacy as BCIs move beyond hospitals.