Microsoft stock price today: MSFT steadies near $400 after Stifel’s rare downgrade

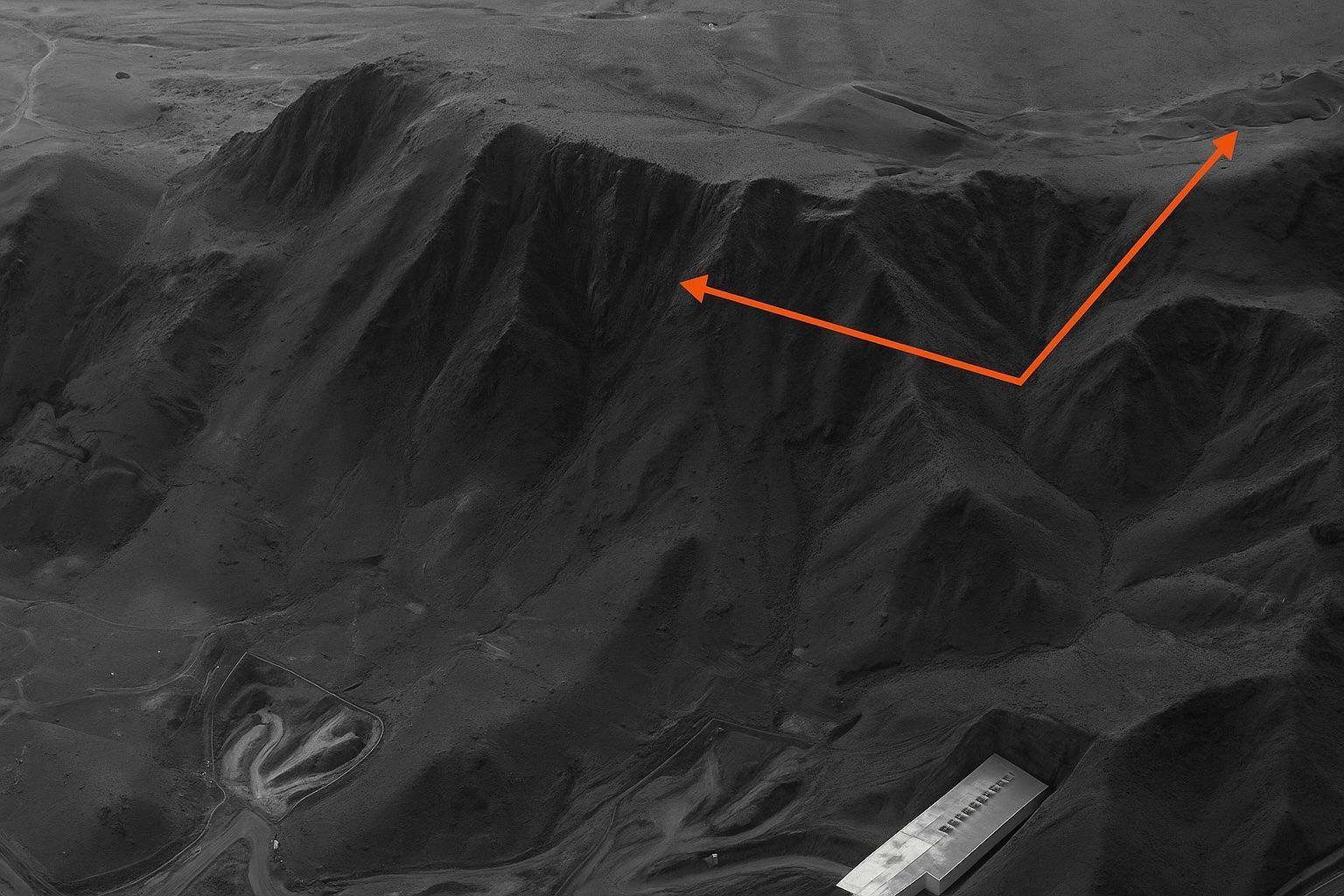

Microsoft shares rose about 1.4% in premarket trading Friday, rebounding after a 5% drop to $393.67 on Thursday. Stifel downgraded the stock to Hold and cut its target to $392, citing concerns over AI spending and cloud competition. The S&P 500 software index fell 4.6% Thursday, erasing about $1 trillion in market value since January 28.