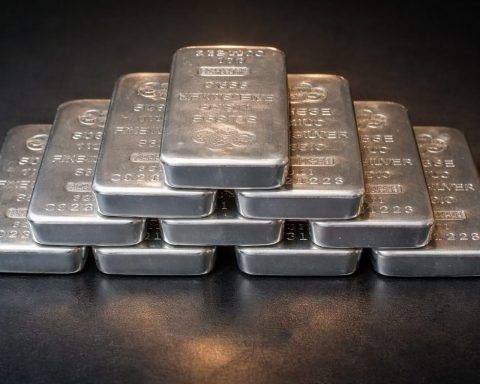

Silver price stock today: SLV in focus as spot silver drops 7% from record highs

Spot silver fell 7.1% to $71.02 an ounce early Wednesday, retreating sharply from Monday’s record $83.62. The U.S. dollar hit a one-week high, pressuring metals. CME raised margin requirements for precious metals futures earlier this week. Silver-backed ETFs and mining stocks moved with the metal in late trading.