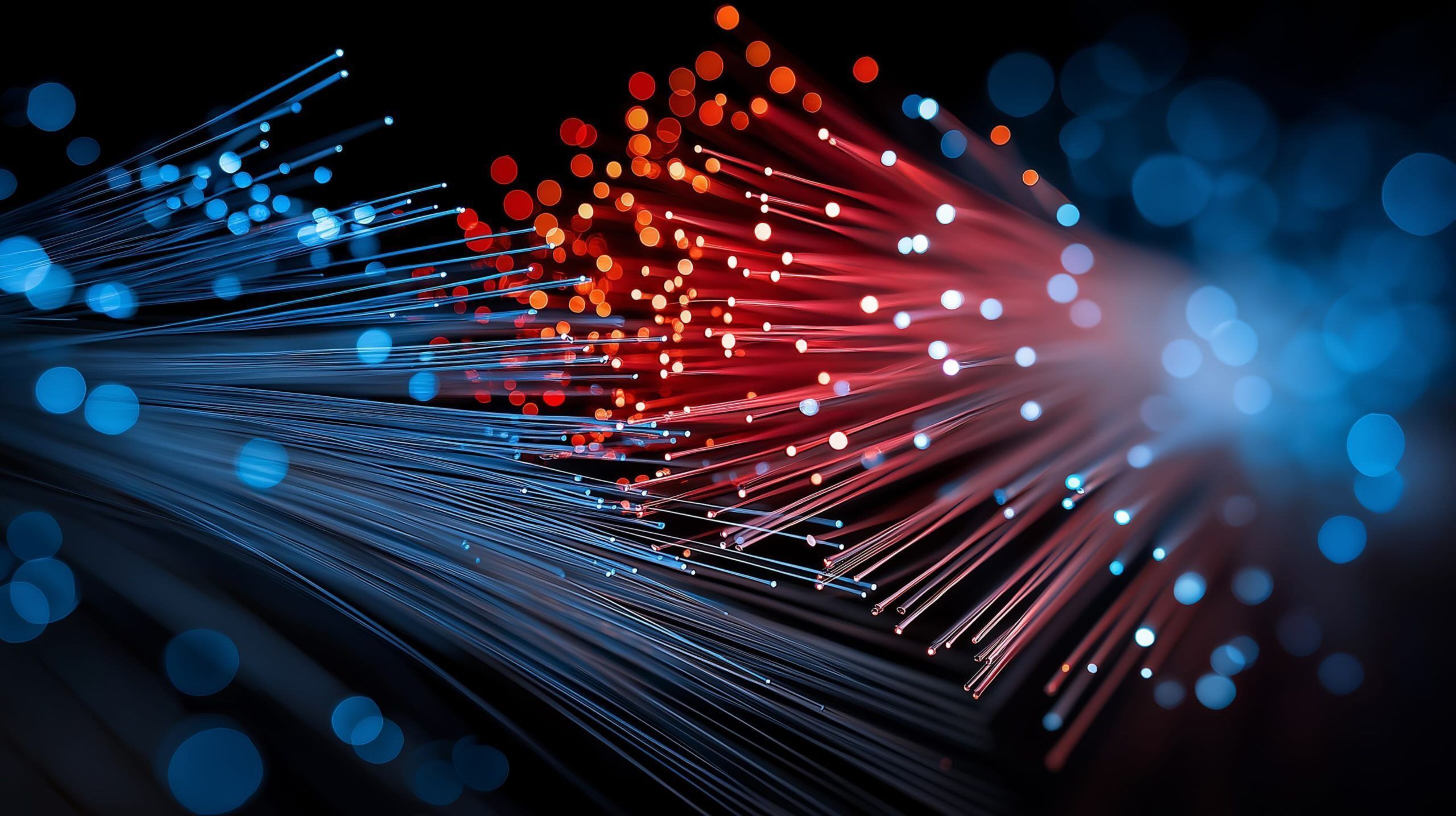

Cisco Stock Soars Over 7% Today After Q1 FY 2026 Earnings Beat and Raised AI-Driven Outlook (13 November 2025)

Cisco shares surged about 7% in pre-market trading Thursday after reporting Q1 revenue of $14.9 billion, up 8% year over year and above estimates. Non-GAAP EPS reached $1.00, topping consensus. The stock closed Wednesday at $73.96 and is now up roughly 25% for the year, nearing record highs. Market cap stands near $290 billion.