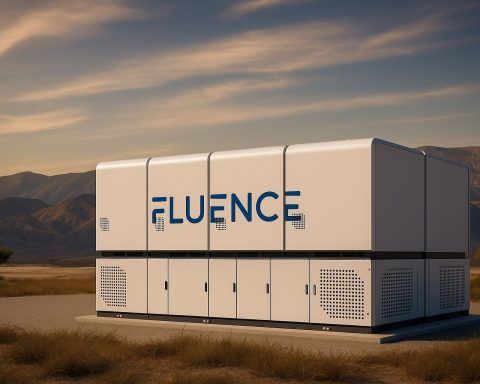

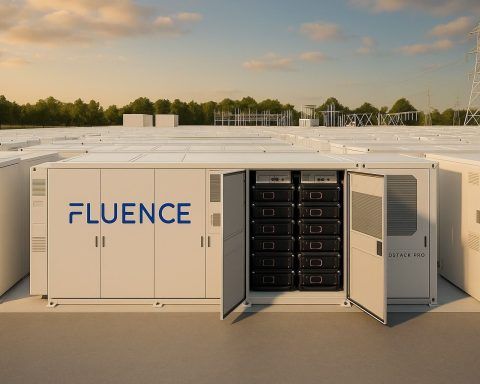

Fluence Energy stock jumps nearly 10% into CPI week — what FLNC investors are watching

Fluence Energy shares jumped 9.4% to $23.20 Friday, with about 4.4 million shares traded as utilities led sector gains and U.S. stocks hit a record close. The next focus for investors is Tuesday’s U.S. CPI release, followed by retail sales data on Wednesday.