Nikkei 225 Ripped 3% as TOPIX Hit a Record—But Traders Keep Staring at 157

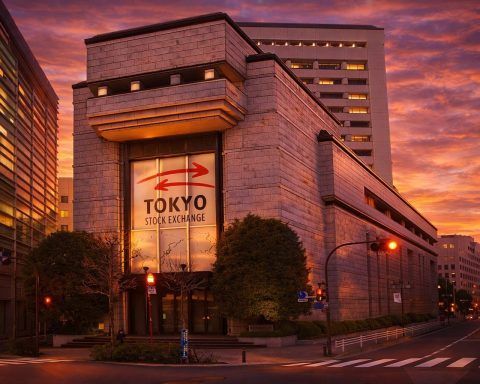

Tokyo — January 5, 2026 — 2:04 a.m. ET Nikkei ripped higher.The Nikkei 225 closed up 3.03% at 51,865 in the Tokyo stock market’s first session of 2026, and TOPIX finished at 3,477.52, up 2.01% after touching 3,486 intraday. Investing Risk-on hit Tokyo.Traders chased chips and exporters as the dollar pushed to 157.295 yen and BOJ chief Kazuo Ueda talked about more rate hikes, while Venezuela headlines barely slowed the bid. Reuters Chips did the hauling.Advantest jumped 6.37% and Tokyo Electron climbed about 6%, tracking a 4% surge in the U.S. semiconductor index on Friday and dragging index points with