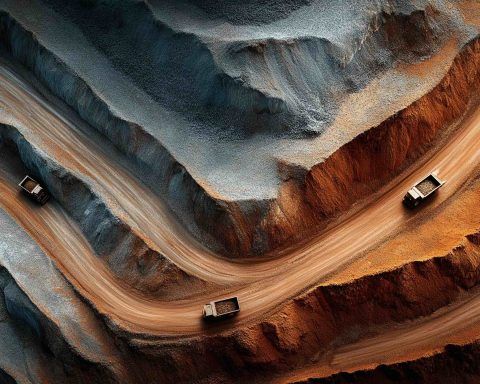

Lithium price today: Albemarle and SQM stock jump before the bell as China policy keeps the rally alive

Albemarle shares rose 4.5% and SQM gained 4.2% premarket after lithium prices in China climbed 2.19% to 163,000 yuan per ton. The rally followed Beijing’s announcement to cut value-added tax export rebates on battery products, with the rebate dropping from 9% to 6% in April and ending in 2027. Albemarle will report Q4 results on Feb. 11.